Where Can SMEs Start Exporting?

For small and medium-sized enterprises (SMEs), exporting is no longer an exclusive activity reserved for large corporations. Global digitalization, diversified supply chains, and evolving buyer behavior have created new entry points for SMEs to participate in international trade. However, many SMEs still face uncertainty about where and how to begin exporting in a structured, sustainable way. This article provides a comprehensive analysis of where SMEs can start their export journey, examining market contex

In the evolving landscape of global trade, small and medium-sized enterprises play an increasingly important role. SMEs contribute significantly to employment, innovation, and economic resilience in many countries, yet their participation in international trade often remains limited. A central question frequently raised by SME owners and managers is simple in form but complex in substance: where can SMEs start exporting? Addressing this question requires an understanding of both market realities and internal business readiness.

Historically, exporting was associated with high fixed costs, complex regulations, and reliance on intermediaries. These barriers disproportionately affected SMEs, which often lacked the financial and managerial resources to navigate foreign markets. Today, while many challenges persist, structural changes in global commerce have created new opportunities for SMEs to enter international markets more gradually and strategically.

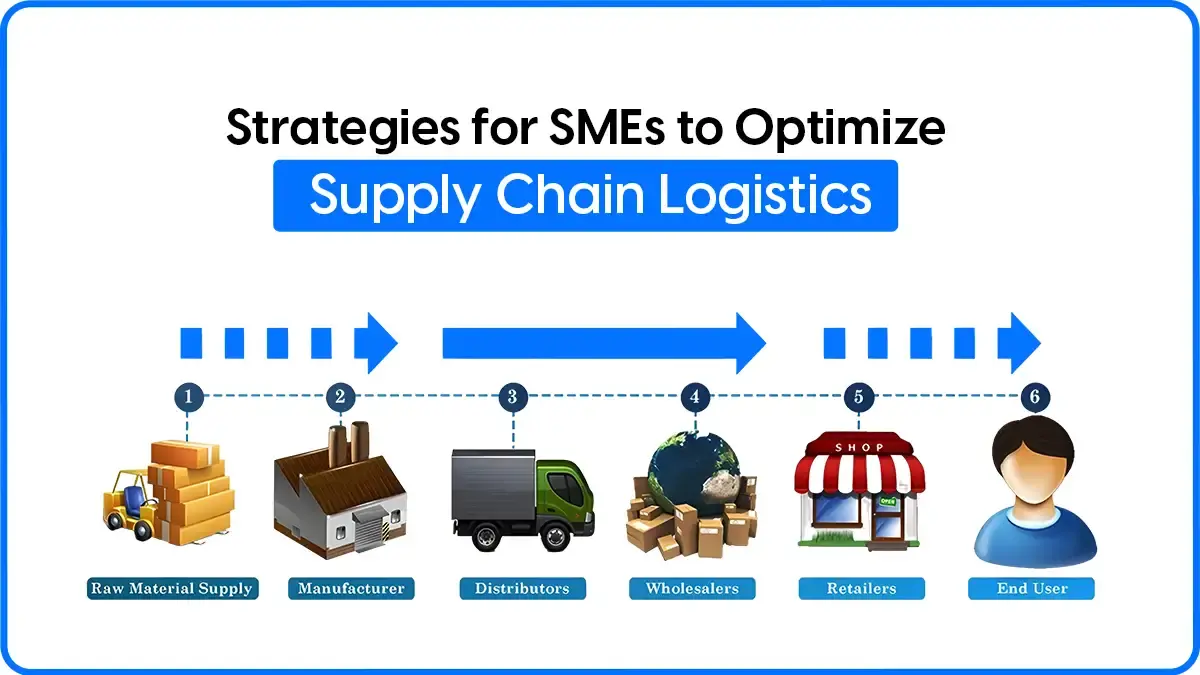

One of the most important shifts has been the fragmentation of global value chains. Large buyers increasingly source from a wider range of suppliers to diversify risk and increase flexibility. This trend has opened space for SMEs that can meet specific quality, volume, or customization requirements. Rather than supplying entire markets, SMEs can participate in niche segments or as specialized suppliers within broader supply networks.

At the same time, buyer behavior has changed. International buyers now conduct extensive online research before engaging with potential suppliers. Digital presence, transparent information, and responsiveness have become critical factors in initial supplier evaluation. For SMEs, this shift reduces dependence on physical trade missions and intermediaries, allowing export activities to begin from the company’s existing location.

From a practical standpoint, SMEs can start exporting through several interconnected pathways. One common starting point is indirect exporting. In this model, SMEs supply products or components to domestic exporters, distributors, or larger firms that already have established international channels. While indirect exporting limits direct market exposure, it allows SMEs to gain experience with international standards, documentation, and quality requirements. This learning phase can be valuable for building internal capabilities and confidence.

Another pathway is direct exporting through digital channels. Online B2B platforms have become accessible entry points for SMEs seeking direct engagement with international buyers. Platforms such as ECVN.COM provide structured environments where SMEs can present company profiles, product information, and engage in preliminary discussions with potential partners. These platforms reduce initial market entry costs and allow SMEs to test international demand without committing extensive resources.

Market selection is a critical decision in the early stages of exporting. SMEs often assume that exporting requires targeting distant or highly developed markets. In practice, many SMEs begin with nearby or culturally similar markets, where regulatory frameworks, consumer preferences, and logistics are easier to manage. Regional trade agreements and shared standards can further lower entry barriers. Over time, experience gained in these markets can be leveraged to expand into more complex destinations.

Product readiness is another determining factor. Not all products are equally suitable for export in their current form. SMEs must assess whether their products meet international quality, safety, and packaging requirements. In some cases, minor adaptations may be sufficient; in others, more substantial investments are required. Understanding product-market fit is essential to avoid costly missteps.

Beyond products, organizational readiness plays a decisive role in export success. Exporting requires consistent communication, documentation management, and responsiveness to buyer inquiries. SMEs must evaluate whether they have the human resources and internal processes needed to support these functions. In many cases, exporting begins as a part-time activity managed alongside domestic operations. While this approach is common, it requires careful prioritization to maintain reliability.

Regulatory compliance represents another significant consideration. Exporting involves compliance with both domestic export regulations and foreign import requirements. These may include product certifications, labeling rules, customs documentation, and payment regulations. For SMEs, the complexity of compliance can be daunting. However, starting with simpler markets or working with experienced logistics and trade service providers can help mitigate this challenge.

Financial readiness is closely linked to export feasibility. Export transactions often involve longer payment cycles, currency risks, and upfront costs related to production and logistics. SMEs must assess their cash flow capacity and risk tolerance. Gradual entry strategies, such as small initial shipments or pilot orders, allow SMEs to manage financial exposure while building export experience.

Institutional support mechanisms also play an important role in helping SMEs start exporting. Many governments and trade promotion organizations offer export training, market information, and matchmaking services. While these programs vary in effectiveness, they can provide valuable guidance, particularly in the early stages. SMEs that combine institutional support with digital tools are often better positioned to navigate initial challenges.

Digital platforms have become especially relevant in this context. ECVN.COM, as a cross-border B2B platform, supports SMEs by providing a structured space to present standardized information and engage with international counterparts. For SMEs, this environment reduces information asymmetry and allows for incremental learning. By observing buyer inquiries and engagement patterns, SMEs can gain insights into market demand and adjust their strategies accordingly.

Importantly, exporting should not be viewed as a one-time decision but as a gradual process. Many SMEs begin by responding to unsolicited inquiries from abroad, often through online channels. These initial interactions, while sometimes opportunistic, can serve as learning opportunities. Over time, SMEs can formalize their export activities by developing clearer market strategies, improving documentation, and strengthening internal processes.

From a long-term perspective, the strategic value of exporting extends beyond revenue diversification. Exporting exposes SMEs to international competition, higher standards, and new ideas. This exposure can drive innovation, improve productivity, and enhance overall competitiveness. Even limited export activities can have positive spillover effects on domestic operations.

However, it is important to acknowledge that exporting is not suitable for every SME at every stage. Market conditions, product characteristics, and internal capacity must align. SMEs should approach exporting with realistic expectations and a clear understanding of risks. Failure to deliver consistently or comply with requirements can damage reputation and strain resources.

The long-term role of digital ecosystems in SME exporting is likely to grow. As trade becomes more data-driven and transparent, SMEs that invest in digital readiness will be better positioned to participate. This includes maintaining accurate digital profiles, responding professionally to inquiries, and using data to inform decision-making. Platforms like ECVN.COM contribute to this ecosystem by lowering entry barriers and supporting structured engagement.

In conclusion, SMEs can start exporting from multiple entry points: indirect supply relationships, regional markets, digital platforms, or direct buyer inquiries. The most appropriate starting point depends on product readiness, organizational capacity, financial resources, and strategic objectives. By adopting a gradual, learning-oriented approach and leveraging digital tools and platforms such as ECVN.COM, SMEs can integrate into global trade in a sustainable and manageable way. Exporting, when approached strategically, becomes not only a growth opportunity but also a pathway to long-term resilience and competitiveness.